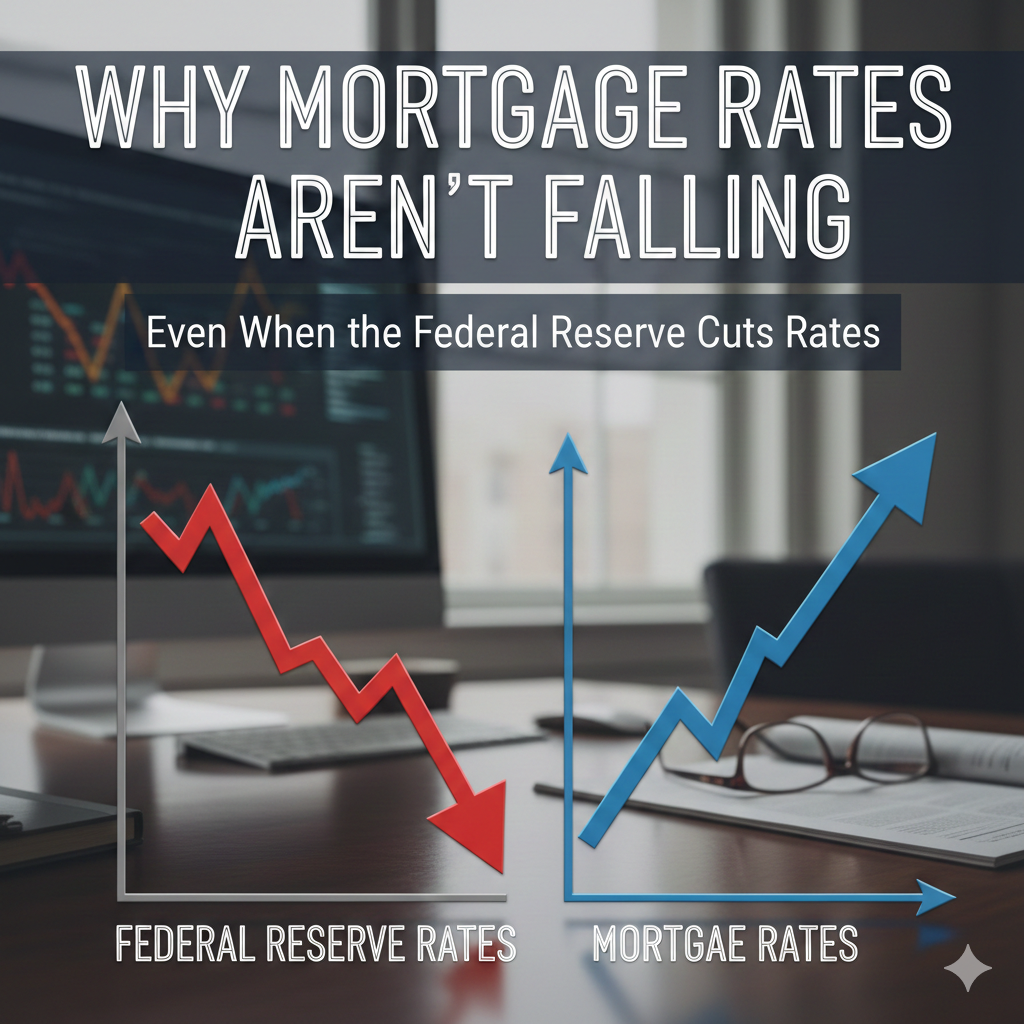

Why Mortgage Rates Aren’t Falling Even When the Federal Reserve Cuts Rates

Many buyers and homeowners assume that when the Federal Reserve cuts interest rates, mortgage rates should immediately follow. So it’s understandable that people are confused and frustrated when the Fed announces a rate cut and mortgage rates stay stubbornly high.

The reality is that mortgage rates and the Federal Reserve’s rate are related, but they are not the same thing. Here’s what’s really going on.

The Fed Controls Short-Term Rates Not Mortgage Rates

The Federal Reserve sets the federal funds rate, which is the overnight rate banks charge each other to borrow money. This rate influences:

Credit cards

Auto loans

Business loans

Savings account yields

Mortgage rates, however, are long-term rates, typically tied to the 10-year U.S. Treasury bond, not the Fed’s overnight rate.

That means mortgage rates respond more to long-term economic expectations than to a single Fed decision.

Mortgage Rates Move on Expectations, Not Headlines

Mortgage rates are forward-looking. Lenders and investors price them based on what they expect to happen in the future, including:

Inflation trends

Economic growth

Government debt and spending

Global economic stability

Often, markets “price in” expected Fed cuts months in advance. By the time the Fed actually cuts rates, mortgage markets may have already reacted or may be reacting to new concerns instead.

In some cases, mortgage rates can even rise after a Fed cut if investors worry inflation will remain sticky or economic growth will stay strong.

Inflation Is Still the Biggest Wild Card

Inflation plays a major role in mortgage pricing.

When inflation is higher or unpredictable, investors demand higher returns to protect the value of their money over time. That means higher mortgage rates, regardless of what the Fed does in the short term.

Until inflation is clearly and consistently under control, mortgage rates are unlikely to drop sharply.

The Bond Market Matters More Than the Fed

Mortgage rates closely track the 10-year Treasury yield. If Treasury yields rise due to:

Strong employment data

Increased government borrowing

Global uncertainty

Mortgage rates often rise even during periods when the Fed is easing policy.

In short: bond investors, not the Fed, are driving mortgage rates right now.

Why This Doesn’t Mean Buyers Should “Wait It Out”

Many buyers are sitting on the sidelines hoping for a dramatic rate drop. But historically:

Mortgage rates tend to move gradually, not suddenly

Competition increases quickly when rates fall

Home prices often rise when borrowing becomes cheaper

Waiting for the “perfect” rate can mean missing opportunities especially in markets where inventory remains limited.

What This Means for Buyers and Homeowners

Rather than trying to time the market perfectly, smart buyers and homeowners are focusing on:

Monthly payment comfort

Negotiating price or seller concessions

Adjustable or temporary rate-buydown options

Refinancing later if and when rates improve

Real estate decisions are long-term, and financing strategies can evolve over time.

The Bottom Line

Federal Reserve rate cuts don’t automatically translate into lower mortgage rates and they never have. Mortgage rates reflect a broader set of economic forces, particularly inflation expectations and bond market behavior.

Understanding this helps buyers and sellers make more confident, informed decisions without relying on headlines alone.

If you’re curious how today’s rate environment affects your specific situation, I’m always happy to walk through the options.